Understand choice: Make decisions under asymmetric risk

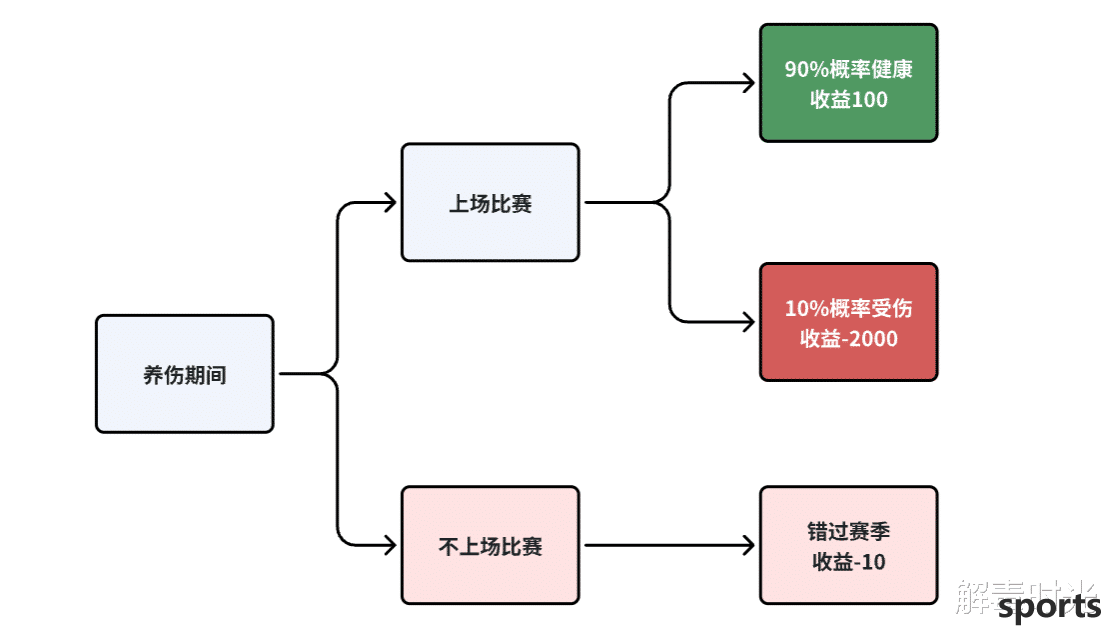

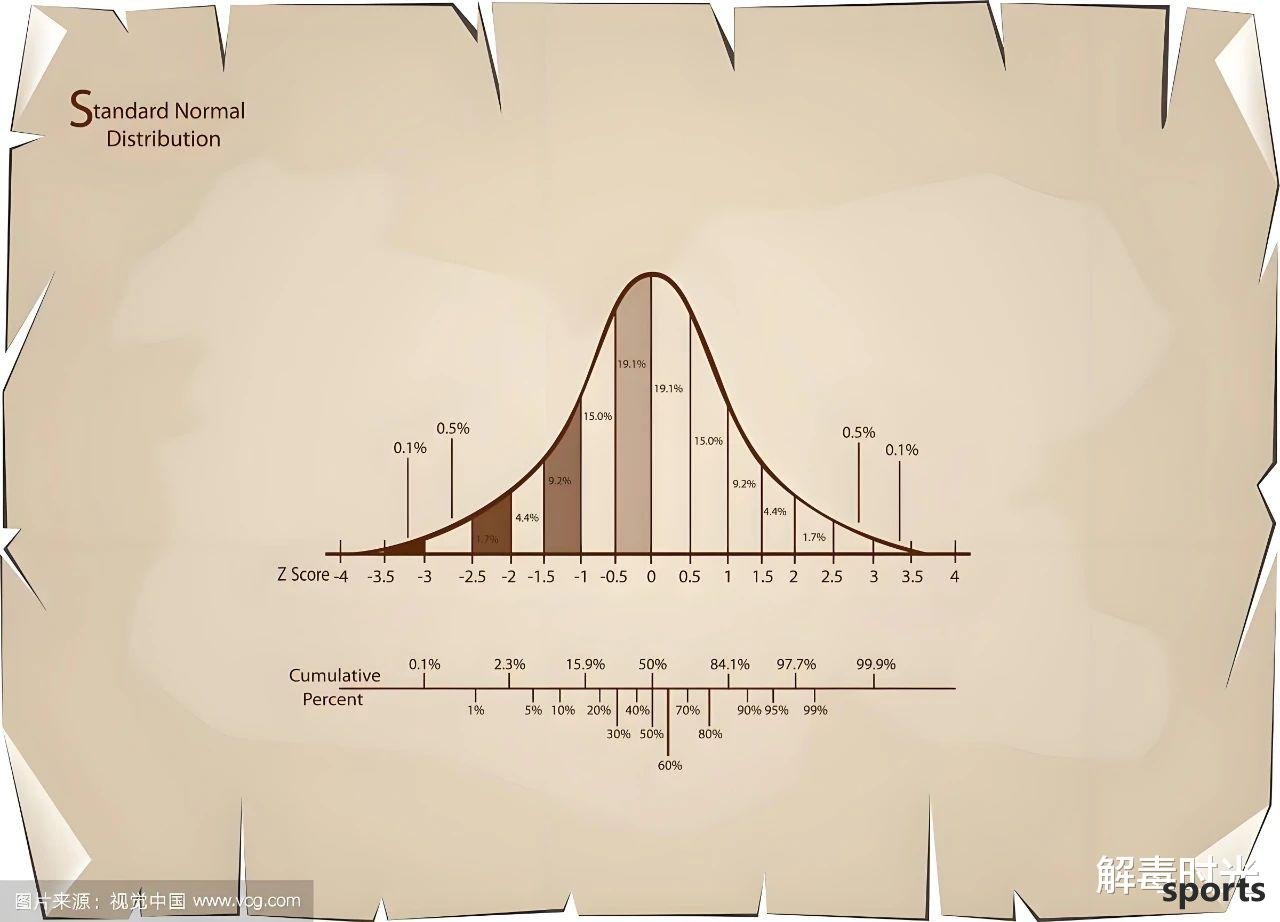

Jordan, one of the greatest basketball players in history, encountered a key choice in his second season in the NBA, wanting to return to the court during his recovery from a foot injury, but the doctor told him that if he plays, there is a 10% chance of getting injured again, jeopardizing his career. Jordan believes that there is a 90% chance that everything will be fine, which is already very good. In response, in order to convince him, his team doctor gave him a choice model, that is, assigning values to each possibility. For Jordan, if you can choose not to play, you will miss this season and you can assign a profit of -10; you can also choose to play, which will bring two possibilities - a 90% chance to stay healthy and finish the season, and a 100 or 10% chance to be injured again, which will affect your career, and assign a value of -2000. According to such assignment, the net income that does not play is -10. If you play, the average expected value is 90%*100-10*2000=-110. In this way, compared the two options, although both are negative, the net income that does not play is obviously better, so the team doctor does not agree with Jordan playing. But Jordan believes that the income from participating in the game in a healthy manner should be 200, while the career loss caused by injury is -1000, so the final comprehensive income of playing is 90%*200-10%*1000=80, which is higher than the income of not playing, supporting Jordan's decision to play. In the end, Jordan returned to the arena without being injured again, continuing his legendary career. Of course, this is not about reviewing the anecdotes in the NBA. The situation Jordan faces reflects a very typical choice situation in life, but most of the time we will not probabilize every possibility and assign various benefits. And the most important thing is that most choices will not be like throwing a coin, with the probability of nearly half of the front and back. More choices are the probability of different outcomes being greatly different. At the same time, different results also correspond to different returns. Understanding this can help us better understand the dilemma we can encounter in daily life. Borrowing a more vivid word to describe this situation can be called "asymmetric risk" in independent selection. This word comes from the book "Asymmetric Risk" written by Nasim Nicholas Taleb. This author is also a master of uncertainty, and his more well-known works include "Black Swan", "Anti-Fragile" and "The Fool of Random Walking". However, the asymmetric risk mentioned by Taleb does not refer to the choice situation encountered by a person independently, but refers to the situation in which the risk is unevenly distributed in a certain transaction or relationship, resulting in one party taking significantly greater risks than the other party, and the returns may be disproportionate. In modern society, the most obvious thing is that the so-called agency system is an asymmetric risk relationship between professionals and their clients, such as financial managers and their clients. Of course, many service industries, even doctor-patient relationships, are asymmetric risks. The current system forces doctors to transfer risks from themselves to patients, from now to the future, or from the nearer to the further future. Taleb's interpretation of asymmetric risks starts with the Hammurabi Code: The core idea of the Hammurabi Code is to establish a reciprocal relationship in human interactions to prevent people from passing on the hidden "tail risks". What is "tail risk"? It actually means that the probability of something happening is very low. Judging from the probability distribution diagram of the bell shape, it is an extremely low probability event close to both ends. In fact, in the development of human society, asymmetric risks have been confronted, and these traces can be seen in many cultural relics. For example, Hammurabi's homomorphic revenge method: eye for eye, tooth for tooth (Exodus); 15th century divine justice method: love neighbor as love yourself (Leviticus in the Bible); Silver law: do not do to others what you do not want others to do to others (don't treat others in the way you don't want to be treated by others); Golden law: treat others the way you want to be treated (Matthew in the Bible); universally accepted law: act only based on universally accepted laws (Kant). In modern society, it is also easy to see people who participate and do not participate in risk sharing, and even those who are willing to take risks for the benefit of others. There are many fundamental aspects of the existence of a civilized society, but one of them must be to build a risk-sharing group, otherwise the society will collapse. The definition of a risk sharing group is: there is a mechanism in a certain space where others will treat you in the way you treat others; there is also a general norm in that space where individuals treat others by following the precept of "do not do to others what they do not want others to do to others". Taleb gives an interesting example of a group: in any group, as long as there are 3%-4% of the uncompromising minorities, they will devote themselves to sharing risks and defending their own personal interests. In the end, the entire group will obey the preferences and choices of the minority. For example, people who are allergic to peanuts should never eat foods containing peanut butter, but people who are not allergic can eat foods containing peanuts. That's why peanuts are rarely found on flights in the United States, and schools in the United States don't usually serve foods with peanut butter. The result is that American children's digestive system is in an environment without peanut butter stimulation for a long time, which in turn increases the number of people allergic to peanuts to a certain extent. For example, the daughter at home is a stubborn minority who only eats non-GMO foods (or organic foods). Due to her persistence and boycott, other members of the family were transformed and they all only ate non-GMO foods. When the family attended the neighbor's barbecue party, the neighbors had to purchase all non-GMO foods in order to take care of their preferences; then, local supermarkets would find that local residents' demand for non-GMO foods increased, so the supply would also be adjusted. Two asymmetry of Islam also lead to its continuous growth: first, according to Muslim law, if a non-Muslim man marrys a Muslim woman, he must convert to Islam, and as long as one of the newborn's parents is a Muslim, the child will become Muslim; second, becoming Muslim is an irreversible thing, because in Sharia law, apostasy is the ultimate crime and will be sentenced to death. Another modern version of Resistance to asymmetric risks is the employment relationship of the company. "Stability comes from the transformation and compliance of individual behavior." Every institution wants members to lose part of their freedom, and only in this way can people be organized. There are two steps to organize people. First, psychological manipulation of them in the name of training; second, twist them together so that they can participate in risk sharing to some extent, so that they can understand that if they do not obey the authority of the organization, they will lose something. A person will show a strong tendency to obey after being hired for a period of time. If a person feels that he does not work and live like an employee in the company, he will suffer great pain, then this means that he has been fully involved in the company's risk sharing. In return, companies must fulfill their obligations, sign long-term agreements, retain the work of formal employees of these companies as much as possible, allowing them to work until their legal retirement age and enjoy a generous pension. The ideal employee who is suitable for employment has a higher value within the company than outside the company, and they themselves realize higher value from their employers than in the labor market. The famous economist Coase believes that if a company outsources all its business to a contractor and maintains upstream and downstream supply chain relationships through contracts, the legal and business costs of negotiation, agreement and execution of each transaction will be high, which will eventually erode the company's profits. The solution to this problem is to hire employees, with employees with clear job responsibilities to handle each transaction, which replaces the legal and business costs of each transaction with a fixed monthly salary. Theoretically speaking, in a completely free market, information spreads with price changes, and market forces thus guide all participants to gradually become specialized. However, within the company, the market's power to transmit information and allocate resources has been weakened because the efficiency improvement brought about by the free flow of factor resources will be consumed by the aforementioned high transaction costs. Thus, the market embodies its power in another way, which often prompts the company to maintain a golden ratio between formal employees and outsourcing positions, thus achieving a compromise between cost and efficiency. The form of "slavery" created by modern large corporations is amazing. The best effort is to pay him an excess salary so that he realizes that he is not worth the money, and at the same time he is afraid of losing everything in front of him. For example, the dispatched positions of multinational companies. After all, what really matters is not what a person has or doesn’t have, but what he is afraid of losing. The greater the potential loss you care about, the more vulnerable you are. Life requires some sacrifice and certain risks. Only by taking risks and making sacrifices is your life. If I don’t take risks (and sometimes these risks are irreversible and the consequences are irreversible), I can’t really explore and move forward in practice. is also the case. The pursuit of sharing risks has given us a clear emotional tendency towards inequality. There are two kinds of inequality in this world: one is the different equality that people tolerate. There is an inequality between the understanding ability of ordinary people and the foresight of those heroes. For example, Einstein and Leonardo da Vinci. It is not difficult for people to find that there is a big gap with them. The other is inequality that people cannot tolerate, because that guy looks like you, but he will manipulate the system for personal gain, rent-seeking, and obtain improper benefits. We all want to completely eradicate the inequality that benefits from passing on risks, and at the same time are willing to reward those who insist on fighting inequality. For example, two doctors, one of whom is capable, wearing gold wire-framed glasses, has a well-proportioned body, delicate hands, and elegant manners. The other one looks like a butcher, with a fat body, big hands, and vulgar conversation. Which one should I choose? The latter may be better because time and reality work together to filter out those who are not capable, and time and reality don't care about appearance. The latter doctor did not seem to be in this industry, but he worked in this industry for a long time, which shows that he needed to overcome more difficulties than others. Behind each difficult choice, there is the risk of asymmetricality of different options. In every relationship that is deeply hated, there are more or less mixed with asymmetric risks, or recommendations from financial agents that only make money but not lose money, or mothers who take too much risk, deprive their children of their responsibility to experience life. Life is a risk, and if you don’t take appropriate risks, you can’t be considered a real life. Of course, identifying the asymmetry in risks has become an important theme in this adventure, and only then can we embark on our own heroic journey.

- Recent Posts

-

- Suns abandon Bills, 5-year 250

- European media revealed that D

- Several major problems are fac

- 54+52+51, the first person in

- Want to keep 76 people? Yabuss

- The revenue of Hexon Trail Bla

- In 2008, the Lakers trade in

- Tari Ethan will definitely be

- Durant s five best NBA seasons

- The Lakers have been paying at

- Hot Posts

-

- After signing with the Trail B

- "NBA Finals G6" Thunder VS Pac

- Bill wants to complete a buyou

- Thunder substitute Caruso: Gre

- 2-1 in one game! WTA Berlin St

- First-time pick, 25th first-ro

- After the NBA Clippers trade,

- The latest news of the Warrior

- Rockets officially announced 5

- The Suns are finally going to

- Outrageous! The truth about th

- If 13 million is received, run

- US media questioned Yang Hanse

- On May 2, Pelinka s latest int

- Paul George undergoes surgery

- Is Paul expected to join the L

- Anthony: I ve been through man

- 8 first rounds + 60 million sp

- Cavaliers President: Mobley s

- The Warriors "beat" Gobert by

- search

-

- Links

-