The second "Evergrande" appears? It has an annual revenue of over 700 billion, but it owes 60 million and is not worth it.

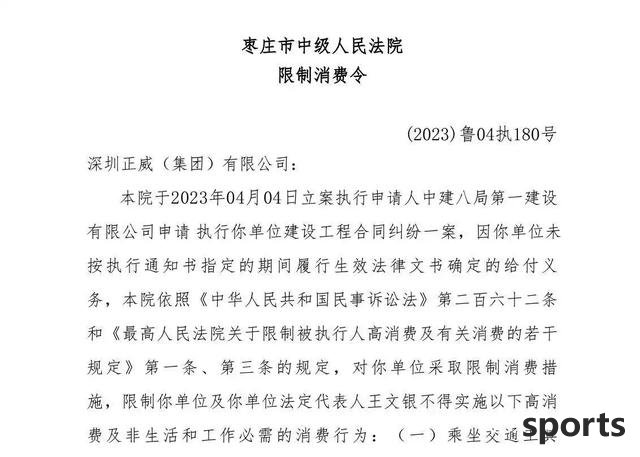

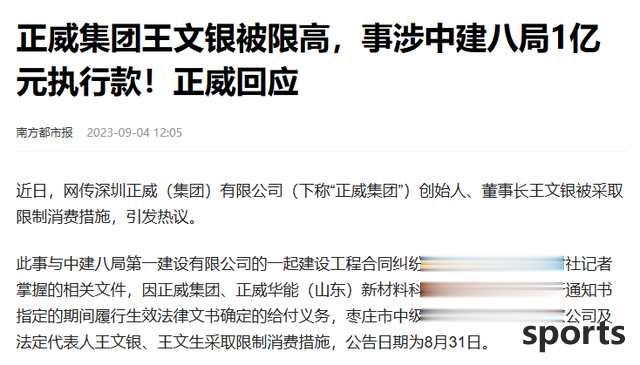

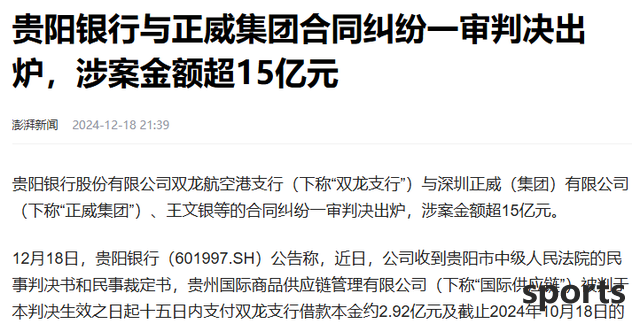

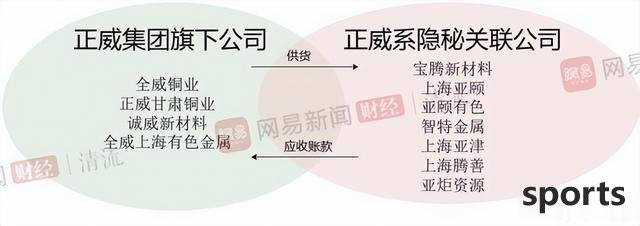

Before reading the article, please click "Follow" to facilitate discussion and sharing. In order to give back to your support, I will update high-quality content every day. Text | Qing Yufei In real life, the rich will borrow money and not repay it, which is really unexpected. Let's first talk about what the concept of annual income of 700 billion yuan is equivalent to earning 2 billion yuan a day, and you can count the money while you are lying down and you can get cramps in your hands. This rich man is Wang Wenyin, the founder of Zhengwei Group. He is even more in line with the halo of the world's bronze king. His annual income exceeds 700 billion yuan. He was actually restricted by the court to spend high consumption due to his 60 million debt, so he couldn't even board the high-speed rail. It's like a person driving a Rolls-Royce saying that he can't afford to add oil, which is really outrageous. We also have to think about whether Wang Wenyin’s Zhengwei Group will become the “second Evergrande” from the known mine king to the deadbeat. The history of Wang Wenyin's fortune from the wire factory to the Fortune 500 Wang Wenyin's fortune is equivalent to a counterattack by a gambler. In the 1990s, Wang Wenyin came to Shenzhen with a few hundred yuan, and started his business by reselling power cords. Regularly speaking, this is an ordinary little boss, but this Wang Wenyin is different and always wants to bet. During the Asian financial crisis in 1997, others were selling their assets, but he had been acquiring equipment with loans, expanding the factory into the largest power plant in the Pearl River Delta. During the SARS period in 2003, copper prices fell very sharply. He took the opportunity to buy copper ore at the bottom and directly extended the industrial chain from the production end to the resource end. In 2008, just during the global financial crisis, Wang Wenyin once again gambled, acquiring overseas copper mines and processing enterprises at a low price, and suddenly became a 100 billion-level enterprise. After these three waves of operations, Zhengwei Group became the leader in the global copper processing industry, and Wang Wenyin also became the world's bronze king. In 2021, Zhengwei Group had revenue of 722.7 billion yuan, surpassing Huawei and Tencent, and entering the top 500 in the world. But no one expected that this seemingly brilliant empire was collapsing little by little. 60 million debt In October 2023, Zhengwei Group was enforced due to a contract dispute of 60.02 million yuan, and Wang Wenyin was restricted from high consumption. As soon as the news came out, everyone was surprised that many people couldn't figure out how a company with a revenue of 700 billion yuan could not even afford 60 million yuan. But something unexpected happened. This is not the first time that Zhengwei Group has been lying for debt. It turned out that as early as 2021, Zhengwei Group was forced to implement the project funds owed to China Construction Eighth Bureau by hundreds of millions of yuan. In 2024, the dispute between Zhengwei Group and Guiyang Bank was even more sensational. Later, after a court investigation, it was found that the problem of Zhengwei Group was much more serious than expected. The copper mine buried underground is more difficult to value than a house that is invisible and intangible. This is claimed to have 30 million tons of copper reserves and is worth 10 trillion yuan, but the actual electrolytic copper depends entirely on external procurement. The so-called own mine cannot even find the specific location, which is definitely asset fraud. Not only that, there are many financial problems. The revenue in 2021 was 700 billion yuan, but the net profit was only 100 million yuan, and the profit margin was less than 0.01%, which is really lower than selling cabbage. What is even more unexpected is that 93% of the revenue of this 700 billion comes from related transactions, and it is really fun to play with the left hand and the right hand. Later, Zhengwei Group was executed in a large amount of total amount, and its subsidiaries' equity was frozen many times, involving more than 3 billion yuan. and many industrial parks have been shut down, and employees' wages have been owed for several months. It is even rumored that the leaders pretend to be producing temporary transport equipment during inspections. Looking at Zhengwei Group's debt snowball, many people will think of another boss named Xu, the once extremely glorious Evergrande. Zhengwei VS Evergrande I have to say that Zhengwei Group and Evergrande have the same recipe and the same taste. First grab land and make money, obtain industrial land at a very low price under the banner of high-tech industrial parks, and then raise funds through land mortgage. Just like the investment of 12 billion yuan in Pingyang Industrial Park in Fujian, the land has been idle for a long time and has become a tool for financing. Zhengwei Group's assets have a very high debt ratio, which is comparable to that of Evergrande's peak period. The difference is that Evergrande relies on selling buildings and Zhengwei rely on telling stories. announced its entry into semiconductors today, and tomorrow it said it would develop new energy, which is actually to make money and survive. Wang Wenyin resigned as the legal person of Zhengwei Group as early as 2023, and transferred the risks to his subsidiaries. This trick is exactly the same as Xu Jiayin's divorce and insurance assets. It is really a textbook for the deadbeat. What's even more amazing is that Zhengwei and Evergrande are still brothers and brothers. It is rumored online that Zhengwei once injected hundreds of millions of dollars into Evergrande, and both parties guaranteed financing, and even transferred the supporting residential buildings of the industrial park to Evergrande Development. Now that Evergrande is thundering, Zhengwei has also fallen into the pit. It really means that it is not a family, not a family.. The collapse of Zhengwei Group has also tore open the fig leaf for the radical expansion of Chinese private enterprises. For GDP, some local governments have given green lights to giants like Zhengwei Group, not only providing land at low prices, but also providing huge subsidies. As a result, the industrial park became a ghost town, and local finances were dragged down, which was not worth the loss. Zhengwei owes many suppliers hundreds of millions of payments, resulting in the bankruptcy of many small and medium-sized enterprises. This is exactly the same as Evergrande's routine of arrears from suppliers, and once again proves that it is not necessarily easy to enjoy the cool under a big tree. Investors should keep their eyes open. Zhengwei New Materials' stock price plummeted and their credit was violated many times, but some investors were still confused by the halo of the world's bronze king. Remember, companies with profit margins below the industry average and account for too high related transactions are probably tricky. Such big but not strong "The giant enterprise is like a boxer wearing an inflatable coat, looking majestic and frustrated with one punch. And the local government was rushing to give policies and land, but now it may regret it. Conclusion Wang Wenyin used the title of World Copper King to package himself, and used false mineral resources and revenue data to deceive trust, In the end, he became a deadbeat. And this company, which claims to have assets of 10 trillion yuan, cannot even give out 60 million yuan, which is a great irony for business integrity. Local governments have lost their land and finances, suppliers have lost all their money, investors have stepped on a big pit, and Wang Wenyin himself has also been ruined. also let us see: bragging and speculation may be awesome, but only integrity and Steady management is the way to go. Evergrande owes money, and Zhengwei owes bragging tax. I hope this lesson will make more companies understand that they will pay it back sooner or later. What do you think about this? References World Copper King Wang Wenyin "High-limited One-day Tour" has a revenue of more than 700 billion yuan per year, but why did it fall to 60 million Yuan Shang? Huaxia Times 2023-10-20 The Paper-The first-instance judgment of the contract dispute between Guiyang Bank and Zhengwei Group was released, with the amount involved exceeding 1.5 billion yuan Baidu Encyclopedia-Shenzhen Zhengwei (Group) Co., Ltd. Baidu Encyclopedia: Wang Wenyin

- Recent Posts

-

- Manchester United: We are the

- The most luxurious configurati

- Foreign media selects the top

- Bayern beat Chelsea, he likes

- Inigo bid farewell to Barcelon

- Figo: I like Nico very much, h

- Disaster! Ajax is in a quagmir

- Reporter: Milan is interested

- Romano: Paratic s 30-month ban

- Why has Nunes not left Liverpo

- Hot Posts

-

- Club World Cup Winning Predict

- Another upset! Swedish star Mo

- [Today s Event] 3-string 1: Ma

- Upset! Real Madrid draws again

- The empty goal failed! The Chi

- Real Madrid has made great cha

- Barcelona Lamacia scored a goa

- Unwilling to give up! De Bruyn

- Manchester United has a new mi

- Master level! The 17-year-old

- 92 minutes of the game! The pl

- Alonso s intervention and inte

- Foden took Burberry s hard pho

- Italian media: Arnau & Cor

- The number of successful playe

- He is the only player called "

- The Club World Cup was also di

- 40-year-old Cazorla: Before re

- Donnarumma suggests that Paris

- Chelsea faces the trouble of c

- search

-

- Links

-